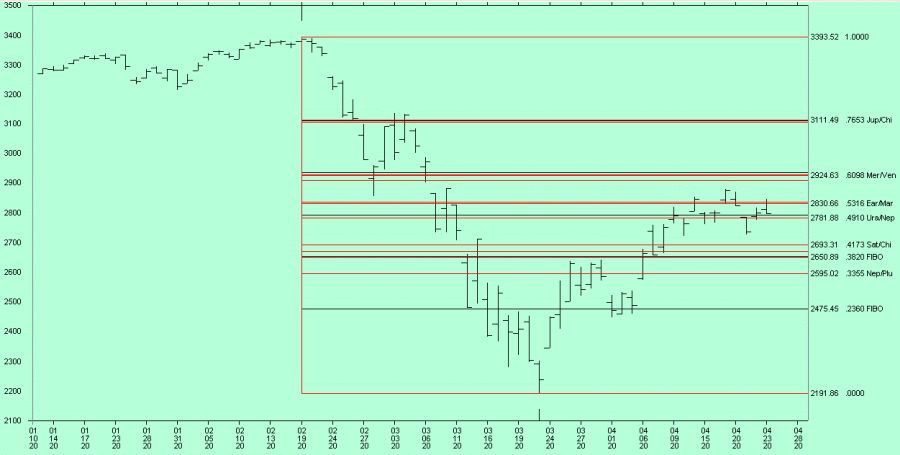

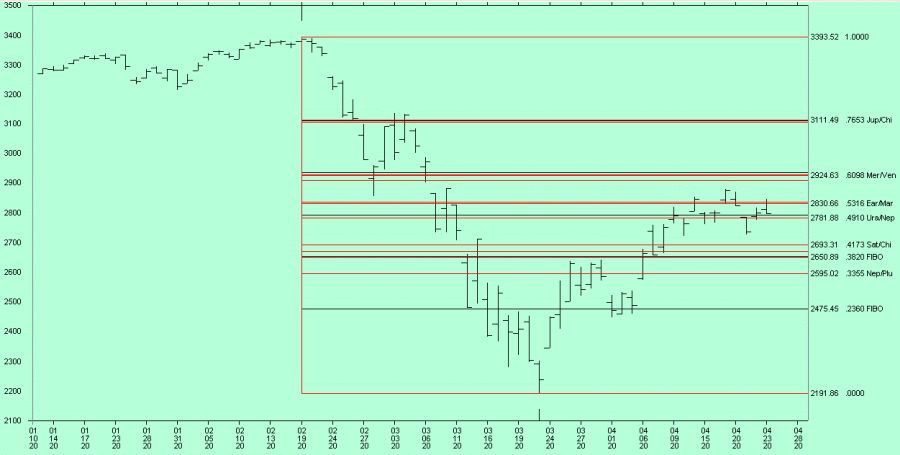

S&P500 Wave 1

(Jan 15, 2016 to Feb 19, 2020) | | 2908.20 | | 2788.65 | | 2788.65 - Major | | 2779.63 | | 2658.50 | | 2601.81 - Major | | 2601.81 | | 2587.56 | | 2470.86 | | 2441.73 | | 2414.97 - Major | | 2414.97 | | 2341.34 | | 2183.95 | | 2183.95 - Major | | 2122.67 |

| S&P500 Wave 2

(Feb 19, 2020 to Mar 23, 2020) | | 2835.71 | | 2792.69 - Major | | 2792.69 | | 2781.88 | | 2693.31 | | 2671.20 | | 2650.89 - Major | | 2650.89 | | 2595.02 | | 2475.57 | | 2475.57 - Major |

| S&P500 Wave 3 - Current

(Began Mar 23, 2020) | | 2913.75 - major | | 2844.74 - major | | 2804.22 - major | | 2790.65 - major | | 2769.13 - major | | 2746.22 - major | | 2694.56 - major | | 2661.22 - major | | 2650.79 | | 2638.67 - major | | 2632.71 - Major | | 2554.00 - Major | | 2547.48 | | 2494.13 - Major | | 2480.80 - Major | | 2474.50 | | 2472.69 - Major | | 2468.57 - Major |

|